Corporate Governance report

The Bank takes pride in ensuring that exceptional standards of corporate governance are met according to international standards of best practice. Sound corporate governance is central to achieving BBK’s objectives and fundamental in maintaining a leading position within the local and regional banking sectors.

Corporate governance vision

BBK and its wholly owned subsidiaries shall continue to enhance shareholders’ value, protect their interests, and defend their rights by practising the pursuit of excellence in corporate life. The Bank shall not only comply with all statutory requirements – including the Corporate Governance Code of the Kingdom of Bahrain and the High Level Controls module of the CBB rulebook – but also formulate and adhere to strong corporate governance practices. BBK and its wholly owned subsidiaries shall also continuously strive to best serve the interests of all other stakeholders, including clients, employees, regulators and the public at large.

The adoption and implementation of corporate governance is the direct responsibility of the Board of Directors, and this endeavour is in line with the policies of regulatory authorities and statutory requirements in the Kingdom of Bahrain and other countries where BBK operates.

Compliance with Corporate Governance regulatory requirements:

The Bank ensures compliance with the Corporate Governance Code of the Kingdom of Bahrain, the CBB requirements in this regard. There were a few procedural issues which need to be enhanced to be in full compliance in relation to improving AGM notice and additional disclosures to the shareholders at the time of elections, enhancing the terms of reference of some of the committees, which were addressed immediately. Further the composition of the Risk Committee of the Board need to be enhanced to have more independent Directors.

Initiatives in 2020

BBK implemented a number of initiatives over the past year to fulfil its corporate governance strategy and other requirements emerging during the year.

- The evaluation process for the Board and its committees was successfully completed and recommendations were made for improvement. In 2020, the evaluation process was carried out by an external party as this is the practice at the Bank at the start of each new Board term. The external party, which is a consulting office specialized in corporate governance matters produced its report and presented it to the Board. The indicators concerning Board dynamics, function and diversity were all positive. The main recommendations are mentioned under Board and Committee evaluation section of this report.

- The Board reviewed the independence of Directors through an annual exercise taking into consideration the regulatory requirements, Board determination as well as best practice.

- The Board achieved better gender diversity by having two new lady Directors on the Board of Directors. Other Bank lady officials were inducted in the Board of Directors of the Bank’s subsidiaries.

- A new Director’s Appointment Letter in line with best international practice for the Bank and its wholly owned subsidiaries was developed and signed by all Directors. The letter covered code of conduct, issues relating to conflict of interest, rights and obligations of Directors and their remuneration.

- A new power of attorney was approved by the Board delegating the overall managmaent of the Bank to the Group Chief Executive (GCE) and establishing legal relationship with the GCE.

- All Board and Corporate Governance manuals and policies, Committee’s Terms of References and procedures were reviewed and approved by the Board with enhancements during 2020. The wording of the manuals and polices are published on the Bank’s website.

- Awareness programmes were arranged for the Board and Executive Management with the objective of continuous development and keeping abreast of updates in market. A full list of programs presented during 2020 are disclosed in this report.

- The Board and the Executive Management attended a training session on sustainability and ESG and the Board requested to prepare a framework for this function at the Bank.

- Full induction programs were arranged for newly appointed Board members including presentations, meeting with the Chairman of the Board, the Group Corporate Secretary and the Executive Management.

- The Board and its wholly owned subsidiaries adopted and implemented a new improved cloud based Board meeting management solution with enhanced features to complement the Bank initiatives for having paperless platforms. The Board also ensured similar arrangement is followed by the Management.

- The Bank took all necessary measures to protect the interest of all stakeholders and priority was given to the Bank employees during the COVID 19 pandemic as elaborated in the Group Chief Executive’s review.

- The Bank signed a new listing agreement with Bahrain Bourse Company (BHB) to comply with new listing requirements with enhanced disclosure procedure including announcements relevant to all stakeholders.

- The Bank complied with Bahrain Bourse Company’s Board resolution concerning transfer of unclaimed dividends to the dedicated fund established by BHB after scrutinizing the legal and regulatory requirements.

- The Bank reviewed its Key Persons (insiders) policy with enhancements and improved the relevant procedures to ensure compliance with regulatory requirements and in line with best practice.

- The whistle blowing procedures were simplified to encourage employees to freely express their views about undeclared risks.

Risk appetite statement

The Bank’s risk appetite is set annually by the Board of Directors with the goal of aligning risk-taking with statutory requirements, strategic business objectives and capital planning. The Board of Directors has a key role in the implementation of the Bank’s risk appetite by steering utilization of different forms of financing, the Bank’s geographical operating areas and markets, funding and liquidity management. The Board of Directors also monitors BBK’s adherence to the Risk Appetite Statement and makes necessary modifications to capture changes in the Bank’s strategic priorities, operating environment, and risk profile.

The vision documents, annual and three year strategy, along with the Bank’s internal policies, mandate framework, rules and guidelines create the overall framework for the Bank’s risk-taking. The Risk Appetite Statement complements these key documents by outlining the main considerations in the Bank’s risk-taking, risk mitigation and risk avoidance.

The purpose of the Risk Appetite Statement is to state clearly the general principles for the Bank’s risk-taking, to raise risk awareness across the organisation, and to guide the staff regarding accepted and unacceptable behavior. The Risk Appetite Statement is implemented through the Bank’s operational policies and procedures, monitoring metrics, limit system, Key Performance Indicators (KPIs) and internal controls. The Risk Appetite Statement is thus embedded in the Bank’s core processes and affects the operations of the Bank in a holistic way.

BBK is subject to banking supervision and prudential regulations. The Bank’s risk management systems and procedures are reviewed and refined on an ongoing basis in order to comply strictly with regulations in all jurisdictions it operates in; as well as with what the Bank identifies as the relevant market standards, recommendations and best practices. This principle also applies to the Bank’s risk appetite framework.

The basic objectives of the Risk Appetite Statement are the following:

- To provide a clear articulation of the Bank’s risk-taking, risk mitigation and risk avoidance, and to define the risk-taking at the aggregate level. The Risk Appetite Statement creates a foundation for effective communication of risk among internal and external stakeholders;

- To increase understanding of BBK ’s material risk exposures and raise risk awareness across the organisation;

- To positively impact the defined risk culture of the Bank.

The Bank’s risk-taking is primarily in its core activity of lending. BBK finances its activities through equity, retail, corporate deposits, issuing bonds on the international capital markets and through market borrowings. The funding base is diversified across currencies, maturities and geographic areas. BBK’s operating model relies on its ability to obtain funding at a favorable cost, which enables lending, on attractive terms, to its clients. BBK’s funding advantage builds on its sound financial profile and strong shareholder support.

To support its lending and funding operations, the Bank maintains a portfolio of liquid assets. The primary objective of the liquid portfolio is to ensure that the Bank is able to operate and continue its core activities even during stressed market conditions. The composition and maturity profile of the liquidity portfolio are aligned with this objective.

The Risk Appetite Statement sets the tolerance for risk-taking in BBK’s operations within the Bank’s Risk capacity. Risk limits and risk profile assessment are other key elements in the implementation of the Bank’s risk appetite framework.

Risk capacity is limited by the financial and non -financial resources that the Bank has at its disposal. The risk appetite is set to a level within the risk capacity to ensure that the Bank’s risk exposure remains sustainable.

Financial resources consist of the Bank’s paid-in capital and retained earnings, together with customer deposits, funds raised through bonds, borrowings from Central Bank and other Financial Institutions. Non-financial resources are the skills and competences of the staff, IT systems, internal procedures and control systems. The Bank’s risk-bearing capacity builds on a careful customer selection process, individual credit mandate reviews and a thorough credit-granting process. Therefore, financial resources and robust governance contribute both to maintaining the Bank’s competitive position and its strong capital and liquidity position.

Risk limits are used to allocate the aggregate risk-taking mandate to business lines and portfolios. The main risk limits are established in the Bank’s risk management policies and approved by the Board of Directors. The limit system sets boundaries for the accepted level of credit, market, liquidity and operational risk within the established risk appetite. The actual position through the risk limits are reviewed at various levels (Board Risk Committee, Risk Management Committee ‘RMC’, Asset Liability Management Committee ‘ALMC’, Senior Management, etc.) depending on the nature of limits and as specified in the relevant Risk Policies. The Board and Senior Management have overall responsibility for determining the Risk Appetite of the Bank, which will be measured and monitored by the Business Verticals in their operational activities.

Risk profile assessment aims to ascertain that the Bank’s risk profile is within Risk limits and consequently within the Risk Appetite and Risk Capacity. Risk profile assessment is a point-in- time evaluation of the level and types of the Bank’s risk exposures. The assessment includes an evaluation of the Bank’s material risks, like credit, market, liquidity, and operational risk.

Credit Risk

BBK is exposed to risk primarily in its core activity of lending to individuals, corporations, small/medium enterprises, governments, public sector entities, financial institutions, etc. Lending exposes the Bank to credit and concentration risks and to variations in the business cycle. Each lending is thoroughly analysed from several perspectives (for example: default risk, financial risks, customer due diligence, legal risk, currency risks, etc.) to ensure that financing decisions have sound foundations. The overall target of the credit risk management is to maintain high portfolio quality with appropriate risk diversification in order to avoid excessive risk concentrations. Account grade rating, industry concentration limits, risk pricing, etc. are set and monitored.

Market Risk and Treasury

Funding, asset and liability management and management of the portfolio of liquid assets are the integral part of the Bank’s business operations.

The funding base of BBK is diversified across currencies, maturities and geographic areas. The Bank effectively manages the risk exposures arising mainly through maturity mismatches between assets (loans and treasury investments) and liabilities (deposits, borrowings and equity). The Bank maintains a robust liquidity portfolio to ensure that the Bank is able to operate and continue its core activities, even during stressed market conditions.

BBK manages its interest rate risk by financing/investing in a combination of fixed or floating-rate assets, and this allows the Bank to generate stable earnings and to preserve its capital base in the long term. BBK’s liquidity portfolio is invested in high quality assets and in doing so, BBK takes limited credit risk (credit default and spread risk).

BBK mitigates its currency risk and most of interest rate risk arising from funding and lending operations by hedging with derivatives. The use of derivatives exposes BBK to counterparty credit risk, liquidity risk, currency basis risk and operational risks. BBK uses netting and collateral agreements to manage its risk towards derivatives counterparties.

Triggers / Policy limits are set as per the Bank’s internal risk policies and procedures. This includes FX Net Open Position and VAR, Market Risk VAR, Interest Rate Risk (Gap, Stop Loss & VAR), amongst others.

Earnings

Banking involves well-judged risk-taking, where all transactions should provide a reasonable margin to compensate for the risk taken. BBK offers financing on competitive market terms and aims for stable earnings, enabling the formation of capital reserves, organic growth, and reasonable return on capital in the long term.

Lending operations, the primary source of credit risk, should provide appropriate return for the level of risk assumed.

Treasury operations, through cost-effective funding and prudent asset and liability management, should contribute to the Bank’s overall returns in line with the defined business objectives and the core objective of safeguarding the Bank’s liquidity.

Earning targets are set and monitored at global, division and business unit level.

Capital

An adequate capital management framework, with an internal capital adequacy assessment process (ICAAP), is an essential part of BBK’s operations. BBK is committed to maintaining a strong risk-based capital position.

The Bank complements risk-based capital adequacy measures with a volume-based leverage ratio measure. It protects the Bank from risks that relate to excessive growth of the balance sheet.

BBK aims to maintain a strong capital position in relation to the aggregate risk exposure at all times. The Bank uses risk-based approaches to assess the capital needs, including stress testing, and the Bank holds robust capital buffers on top of the minimum capital requirement.

The growth of the Bank’s balance sheet should be stable in the long run, while some variation is accepted in the medium term to account for natural changes in the business cycles.

Liquidity

The Bank maintains a robust liquidity portfolio. The primary objective of the liquidity portfolio is to ensure that the Bank is able to operate and continue its core activities without disruption, even during stressed market conditions. BBK maintains a liquidity portfolio where a large majority of the assets are of high quality to support the Bank’s operations and liquidity position. Having a strong liquidity position enables us to carry out our core activities under severely stressed market conditions without access to new funding.

We diversify funding in terms of currencies, maturities, instruments and investor types in order to avoid excessive reliance on individual markets and funding sources.

Liquidity parameters are set to maintain minimum levels as per regulatory guidelines.

Implementation and Review

The primary responsibility for the correct implementation of the Risk Appetite Statement remains with the Risk Management Division.

This Risk Appetite Statement is reviewed at least annually.

Shareholder information

BBK’s shares are listed on the Bahrain Bourse. The Bank has issued 1,361,736,332 equity shares, each with a face value of 100 fils. All shares are fully paid.

During 2020, BBK distributed bonus shares to its shareholders at 5% of the paid-up capital, equivalent to 5 shares for every 100 shares held, for a total of BD 6,484,459. Therefore, the Bank’s paid up capital after the distribution increased to BD 136,173,633 divided into 1,361,736,332 shares as per the following details:

- BD 6,422,556 bonus shares on paid-up capital (not including treasury shares)

- An amount of BD 61,903 bonus shares on treasury shares

Annual Ordinary General Meeting, Extraordinary General Meeting

The Annual Ordinary General Meeting (AGM) and an Extraordinary General Meeting (EGM) were held on 24 March 2020 under high level precautionary measures as required by the relevant authorities due to the COVID 19 pandemic outbreak and in two separate meeting halls connected via video and a maximum of 20 persons in each hall, taking into consideration social distancing and other measures to keep all participants safe.

Apart from normal AGM discussions, the AGM discussed and took decisions regarding the below mentioned items:

- Re-appointing the members of the Sharia Supervisory Board for monitoring Islamic transactions at the Bank. The appointment is for a period of three years renewable, and authorising the Board of Directors to determine their fees.

- Approving the recommendation of the Nomination, Remuneration and Corporate Governance Committee regarding the appointment of five members on the Board of Directors appointed by the major shareholders of the Bank for the term (2020-2022) after obtaining the approval of the Central Bank of Bahrain.

- Election of seven Board members to complete the appointments on the Board of Directors for the term (2020-2022) after obtaining the approval of The Central Bank of Bahrain (The CBB).

The EGM held on 24 March 2020 approved the following:

- The Board’s recommendation to the EGM by increasing the issued and paid up capital from BD 129,689,175 divided into 1,296,891,746 shares to BD 136,173,633 divided into 1,361,736,332 shares as a result of distributing bonus.

The full set of the AGM and EGM minutes and the decisions made at the meeting are published in this annual report.

Annual disclosures at the AGM:

The Bank submits a Corporate Governance Report to the AGM annually, covering the status of compliance with the related regulatory requirements and international best practice.

At the AGM, the Bank discloses and reports to shareholders the details under the Public Disclosure module of the CBB’s rulebook. These disclosures include the total remuneration paid to the Directors, Executive Management, and external auditors and other important disclosures as elaborated hereunder. The total amount paid to Directors and Executive Management is also included in this annual report.

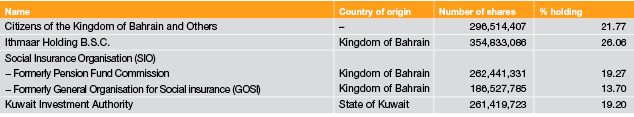

Shareholders composition

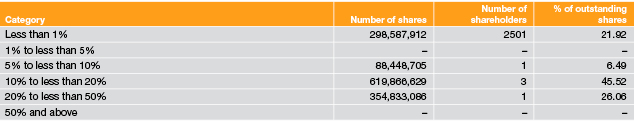

Distribution schedule of each class of equity

Board of Directors’ information

Board composition

The Board’s composition is based on the Bank’s Memorandum of Association and Articles of Association, and comprises 12 members. The Board represents a mix of high-level professional skills and expertise. Furthermore, in compliance with corporate governance requirements, the Board Committees consist of members with the appropriate professional experience. Consequently, the Board has five independent Directors. The independence requirements are reviewed on an annual basis taking into consideration the CBB criteria and Board of Directors determination of the same. The Board periodically reviews its composition and the contribution of Directors and Committees.

The appointment of Directors is subject to the CBB approval. The classification of Executive Directors, Non-executive Directors, and Independent Non-executive Directors follows the definitions stipulated by the CBB. The current term of the Board began in March 2020 and ends in March 2023. Directors are elected/ appointed by the shareholders at the AGM.

The election or re-election of a Director at the AGM is accompanied by a recommendation from the Board based on a recommendation from the Nomination, Remuneration and Governance Committee, with specific information such as biographical and professional qualifications and other directorships.

Group Corporate Secretary

The Board is supported by the Group Corporate Secretary, who provides professional and administrative support to the General Assembly, the Board, its Committees, and members. The Group Corporate Secretary also assumes the responsibilities of Group Corporate Governance Officer and in this context supports the processes of performance evaluation for the Board, Board Committees, and individual Directors as well as the process of access to independent advice and other relevant issues on a Group level. The appointment of the Group Corporate Secretary is subject to approval of the Board.

BBK’s Group Corporate Secretary is Ahmed A. Qudoos Ahmed, who joined the Bank in 2009. His qualifications include a BSc in Engineering from the University of Bahrain in 1996. He is qualified in Board Secretarial practices from George Washington University. He has attended many advance training programmes in corporate governance both in Bahrain and abroad, accumulating over 23 years of experience in the financial sector.

Directors’ roles and responsibilities

The Board of Directors oversees the implementation of the Bank’s strategic initiatives and its functioning within the agreed framework, in accordance with relevant statutory and regulatory structures. The Board ensures the adequacy of financial and operational systems and internal controls, as well as the implementation of corporate ethics and the Code of Conduct.

The Board has a schedule of matters for its decision to ensure that the direction and control of the Bank rest with the Board. This includes strategic issues and planning, performance reviews, material acquisition and disposal of assets, capital expenditure, authority levels, appointment of auditors and review of financial statements, financing and borrowing activities including the annual operating plan and budget, ensuring regulatory compliance, and reviewing the adequacy and integrity of internal controls.

The Board exercises its judgment in establishing and revising the delegation of authority for Board Committees and the Executive Management. This delegation may be for authorisation of expenditure, approval of credit facilities, or for other corporate actions. Such delegation may be approved and expressed under various policies of the Bank. The thresholds for the identified authorities depend upon the operating requirements of the Bank.

The issues of major capital expenditure, divestitures, mergers and acquisitions, and certain strategic investments are within the Board’s authority.

Each Director holds the position for three years, after which he must present himself to the AGM for reappointment. The majority of BBK Directors (including the Chairman and/or Deputy Chairman) are required to attend Board meetings to ensure a quorum. The Board Charter is published on the Bank’s website.

Material transactions that need Board approval

Lending transactions to Directors, at a certain level of exposure, require Board approval. Credit and investment applications exceeding certain pre-defined exposure levels also require Board approval.

Similarly, related party transactions involving members of the Board require Board approval.

Independent professional assistance

The Bank has procedures approved by the Board for allowing Board members to obtain independent professional advice related to the affairs of the Bank or to their individual responsibilities as members, subject to approval by the Board.

Directors’ induction

The Board is required to be up to date with current business, industry, regulatory, and legislative developments and trends that affect the Bank’s business operations. Immediately after appointment, the Bank provides formal induction for a full day. Meetings are also arranged with the Executive Management. This will foster a better understanding of the business environment and markets in which the Bank operates. The induction of the newly appointed Directors took place in April 2020.

Directors’ professional development

A continuing awareness programme is essential and may take many forms, through the distribution of publications, workshops, presentations at Board meetings, and attendance at conferences encompassing topics on directorship, business, industry, and regulatory developments. In terms of the Training and Competency module of the CBB rulebook, each approved person (including members of the Board) is required to complete 15 hours of continued professional development. The full list of programs prepared for the Board of Directors of the Bank and its wholly owned subsidiaries is disclosed in this report.

Board and Committee evaluation

The Board performs a self-evaluation process annually. The Board annually reviews its Charter and its own effectiveness, initiating suitable steps for any amendments. The Board will also review self-evaluations of individual Board members and the Board Committees and consider any recommendations arising out of such evaluation. The relevant policy is published on the Bank’s website.

The evaluation in 2020 was done by a consulting office specialized in corporate governance and the main recommendations emanating from the evaluation process were as following:

- Improving the role of the Board in strategy formulation and follow up of execution.

- Reducing the burden on the Board by reducing Board meeting timings and reviewing the Executive Committee’s approval authorities if required.

- Look at developing succession planning for the Board.

Remuneration of Directors

The Board has adopted a remuneration policy for Directors with well-defined procedures to apply to the Directors’ various remuneration and compensation components, reflecting their involvement and contribution to the activities of the Board and its ad-hoc, temporary and permanent committees.

The basic guideline of the policy is that participation is considered in terms of attendance at meetings. Participation in a meeting by telephone/video conference shall be considered as attendance of the meeting. The relevant policy is reviewed periodically to ensure it is in line with regional best practice. Directors’ remuneration is governed by Commercial Companies Law No 21 for the year 2001, and any amendments thereto, therefore all payments comply with the provision of the law. The individual remuneration is disclosed under remuneration report in this annual report.

Insurance coverage

The Bank provides personal accident insurance coverage for Board Members during travel on Bank assignments. The Bank also has a Directors and Officers liability insurance policy for Directors.

Whistle-blowing policy

The Bank has a whistle-blowing policy with designated officials that employees can approach. The policy provides protection to employees for any reports made in good faith. The Board’s Audit and Compliance Committee oversees this policy. The whistle- blowing policy is published on the Bank’s website.

Key persons (KP) policy

The Bank has established a ‘Key Persons’ policy to ensure that key persons are aware of the legal and administrative requirements regarding the holding and trading of BBK shares, with the objective of preventing abuse of inside information. Key persons are defined to include the Directors, Executive Management, designated employees, and persons under guardianship or control of Key Persons. The Key Persons policy is entrusted to the Board’s Audit Committee. The Key Persons policy is posted on the Bank’s website.

Code of Conduct

The Board has approved a Code of Conduct for BBK Directors and a Code of Ethics for the Executive Management and employees. These codes outline areas of conflict of interest, confidentiality, and the responsibilities of signatories to adhere to best practices. The high-level responsibility for monitoring the codes lies with the Board of Directors. The Directors’ Code of Conduct is published on the Bank’s website.

Relative recruitment/appointment policy

The Bank has in place policies that govern the recruitment and appointment of relatives to the Bank and across its wholly-owned subsidiaries. The policies are:

1. Employment of relatives of first and second degrees are prohibited, whereas employment of relatives of third and fourth degree may be approved by the Executive Management provided it does not lead to a conflict of interest.

2. Employment of relatives at the Bank’s wholly-owned subsidiaries of first and second degree are prohibited for senior managers and above. Any exception must be approved by the Group Chief Executive.

3. As part of the annual reporting, the Group Chief Executive must disclose to the Board those individuals who are occupying controlled functions and who are relatives of any other approved persons within the Bank and its wholly-owned subsidiaries.

Conflict of interest

The Bank has clear policies based on domestic laws and regulations and international best practices to deal with issues related to conflict of interest. This is also stipulated in the Directors Appointment Letters signed between the Board members and the Bank. These policies are posted on the Bank's website and reviewed periodically or whenever needed.

During Board meetings or Board committees and during discussions on topics related to credit applications, investment or other transactions where there may be conflict of interest, the concerned Board member is required to leave the meeting room and any correspondence or documents related to the application will not be sent to him/her. Decisions are made by the Board of Directors or its Committees without the presence of the member concerned and such transactions are recorded in the minutes of the Board meeting or its committees.

In addition, it is the responsibility of the member of the Board and he/she must immediately disclose to the Board that there is a conflict of interest related to his activities and obligations with other parties and not to participate in the discussion and voting, and these disclosures include documents relating to contracts or transactions related to the member concerned.

During 2020, the Executive Committee discussed a number of credit and investment applications relating to accounts of some major shareholders. The Board also discussed some projects related to Aegila, a joint venture with Osool, and also held a number of Board meetings to discuss the opportunity to acquire some of the assets of Ithmaar Holding, which is a major shareholder of the Bank, and in all these cases this policy has been implemented without exception.

Development programmes arranged for board members during 2020

1. Diligent Board Book Orientation program 16/02/2020

2. AML and Compliance workshop 16/02/2020

3. Open Banking 23/07/2020

4. Diligent Boards training 23/07/2020

5. ESG Environmental, Social and Governance 27/10/2020

6. Digital disruption and strategy for Boards 27/10/2020

Number of development programme hours attended by board members, arranged by the Bank or otherwise:

| Board members | Total no. of hours |

|---|---|

| Murad Ali Murad | 26 |

| Sh. Abdulla bin Khalifa bin Salman Al-Khalifa | 35.5 |

| Mohamed Abdulrahman Hussain | 23.5 |

| Hani Ali Al Maskati | 31 |

| Jassem Hasan Ali Zainal | 18 |

| Sh. Khalifa bin Duaij Al Khalifa | 20 |

| Edrees Musaed Ahmad | 15 |

| Ashraf Adnan Bseisu | 26 |

| Mishal Ali Al Hellow/td> | 21 |

| Naser Khalid Al Raee | 40 |

| Ghaneya Al Derazi | 15 |

| Nour Nael Al jassim | 15 |

Environmental, Social and Governance - ESG

BBK’s contribution to the well-being of the community is an integral part of its corporate role. The Bank allocates an annual appropriation for donations to finance community-related projects and initiatives.

BBK has an approved high-level CSR policy. The policy outlines guiding principles and sets criteria for the evaluation and selection of aid requests whether financial or in kind, with the ultimate objective of maximising the return on both the Bank’s social image and the benefit of the community. For details on CSR activities conducted by the Bank, please refer to the Sustainability review section in Part I.

The Board is active in making decisions to broaden the role of the Bank as far as ESG is concerned and the Bank has initiated the development of its ESG framework to be implemented in 2021.

Disclosures relating to the Board of Directors

Directors’ external appointments

Directors and related parties’ interests

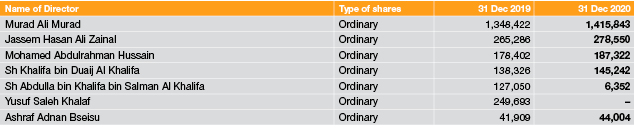

The number of securities held by Directors as of 31 December 2020 was as follows:

Related parties

1. Al Janabeya Company WLL (a family company owned by Mr Murad Ali Murad and his family) owns 1,279,947 shares, and is related to the Chairman of the Board.

Nature and extent of transactions with related parties

None.

Approval process for related parties’ transactions

The Bank has a due process for dealing with transactions involving Directors and related parties. Any such transaction will require the approval of the Board of Directors.

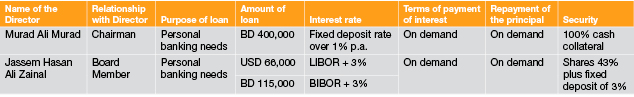

Material contracts and loans involving Directors

Notes:

1. The materiality amount for such disclosures is considered above BD 100,000.

2. 11 Board members hold CrediMax Credit cards with a total limit of BD 147,892 and outstanding amount at the end of December 2020 of BD 23,345.

Directors’ trading of BBK shares during 2020

As per "Directors and related parties' interests" table above.

Board meetings

The Board of Directors meets at the summons of the Chairman (or Deputy Chairman in the event of his absence or disability) or, if requested to do so, by at least two Directors. The Board meets at least four times a year. A meeting of the Board of Directors is deemed valid if attended by more than half of the members.

Meetings of Independent Directors

Since 2012 the Board of Directors has held separate meetings for Independent Directors.

In terms of the Board Charter, minority shareholders look to Independent Directors for representation.

For this purpose, regular Board meetings are preceded by a meeting of Independent Directors, unless the Independent Directors decide that there are no issues to discuss.

The agendas for these meetings are the same as those for the regular Board meetings. During these meetings the Independent Directors express their views about certain issues, especially those relating to minority shareholders. The summary of the proceedings of such meetings is recorded by the Group Corporate Secretary and shared with the Independent Directors and there is an Independent Directors' Committee.

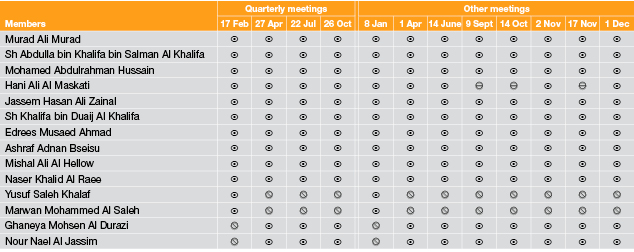

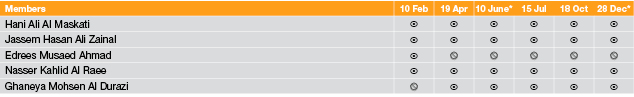

Board meeting attendance

During 2020, 12 Board meetings were held in the Kingdom of Bahrain in the following manner:

Board meetings 2020

Major issues discussed by the Board during 2020

(Subjects that fall under the Board Committees’ scope are recommended by the respective Committee for the Board’s approval.)

| Date of meeting | Subject |

|---|---|

| 8 January 2020 |

|

| 17 February 2020 |

|

| 1 April 2020 |

|

| 27 April 2020 |

|

| 14 June 2020 |

|

| 22 July 2020 |

|

| 9 September 2020 |

|

| 14 October 2020 |

|

| 26 October 2019 |

|

| 2 November 2020 |

|

| 17 November 2020 |

|

| 1 December 2020 |

|

Board committees

Board Committees are formed and their members appointed by the Board of Directors each year, after the AGM. They are considered the high-level link between the Board and the Executive Management. The objective of these Committees is to assist the Board in supervising the operations of the Bank by reviewing any issues that are submitted by the Executive Management and making recommendations to the Board for their final review.

The Board reserves the right to form temporary committees and discontinue them from time to time, as necessary.

Members of the Board are provided with copies of the meeting minutes of the committees, as required by the regulators. During 2020, the Board established an ad-hoc committee to study the Bank’s needs for merger opportunities and raise recommendations to the Board.

The terms of reference for the Board committees (Executive; Audit and Compliance; Nomination, Remuneration and Governance; Risk; and Independent Members) are available on the Bank’s website.

Board Committees’ composition, roles and responsibilities

Executive Committee

| Members | Summary terms of reference, roles and responsibilities | Summary of responsibilities |

|---|---|---|

|

Mohamed Abdulrahman HussainChairman

Sh. Abdulla bin Khalifa bin Salman Al KhalifaDeputy Chairman

Ashraf Adnan BseisuMember

Mishal Ali AlhellowMember

Nour Al JassimMember

|

|

Reviews, approves and directs the executive management on matters raised to the Board of Directors such as business plans, donations, credit/investment applications, and such other proposals within its authority, and the periodic review of the Bank’s achievements. |

Audit and Compliance Committee

| Members | Summary terms of reference, roles and responsibilities | Summary of responsibilities |

|---|---|---|

|

Murad Ali Murad Chairman (Independent)

Jassem Hasan Zanial Deputy Chairman (Independent)

Sh. Khalifa bin Duaij Al Khalifa Member (Independent)

Edrees Musaed Ahmad Member

|

|

Reviews the internal audit programme and internal control system; considers major findings of internal audit reviews, investigations, and management’s response. Ensures coordination among internal and external auditors. Monitors trading activities of key persons and ensures prohibition of the abuse of inside information and disclosure requirements. Approves and periodically reviews the Internal Audit Charter, which defines the purpose, authority, responsibilities and other aspects of internal audit activity. The Internal Audit Charter is available to internal and external stakeholders on request addressed to the Board Secretary. |

Nomination, Remuneration and Governance Committee

| Members | Summary terms of reference, roles and responsibilities | Summary of responsibilities |

|---|---|---|

|

Murad Ali Murad Chairman (Independent)

Sh. Khalifa bin Duaij Al Khalifa Deputy Chairman (Independent)

Marwan Mohammed Al Saleh Member

Mohamed Abdulrahman Hussain Member (Independent)

|

|

Assess, evaluate and advise to the Board on all matters associated with nominations and remunerations of Directors and Executive Management. Also, ensure that the Bank adopts and enhances sound corporate governance practices, which are consistent with the Corporate Governance Code of the Kingdom of Bahrain and the regulatory requirements, and which also reflect best market practices in corporate governance, and makes recommendations to the Board as appropriate. |

Risk Committee

| Members | Summary terms of reference, roles and responsibilities | Summary of responsibilities |

|---|---|---|

|

Hani Ali Al Maskati Chairman (Non-executive)

Jassem Hasan Ali Zainal Deputy Chairman (Independent)

Ghaneya Al Derazi Member

Nasser Khalid Al RaeeMember

|

|

Reviews risk policies and recommends to the Board for approval. Also examines and monitors the risk issues to the Bank’s business and operations and directs the management appropriately. |

Independent Directors Committee

| Members | Summary terms of reference, roles and responsibilities | Summary of responsibilities |

|---|---|---|

|

Murad Ali Murad Chairman (Independent)

Jassem Hasan Zanial Member (Independent)

Sh. Khalifa bin Duaij Al Khalifa Member (Independent)

Mohammed Abdulrahman Hussain Member (Independent)

Ghaneya Al Derazi Member (Independent)

|

|

Provides independent views on certain issues, especially pertaining to minority shareholders. |

Note: The full wording for the Board Committees’ terms of reference is available on the bank’s website www.bbkonline.com

Board Committee meetings and record of attendance

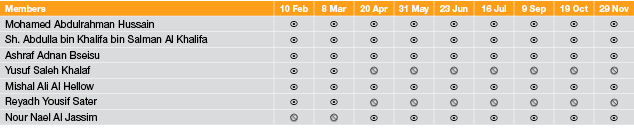

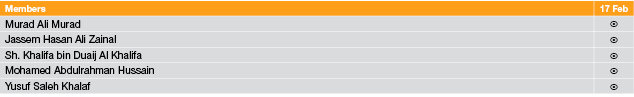

Executive Committee meetings in 2020

Audit and Compliance Committee meetings in 2020

Nomination, Remuneration and Governance Committee meetings in 2020

* Unscheduled meeting

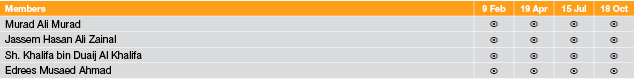

Risk Committee meetings in 2020

* Unscheduled meeting

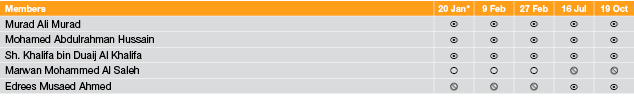

Independent Directors’ Committee meetings in 2020

Other meetings

Mr Murad Ali Murad, Chairman of the Board, attended the periodical CBB prudential meetings on 27 January 2020.

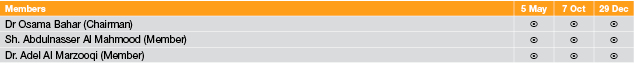

Shariah Supervisory Board disclosures

In 2016, the Bank established a Shariah Supervisory Board as the Bank conducts some of its transactions according to the Islamic Shariah and must ensure that these transactions are within Shariah standards and norms as required by the regulatory authority in the Kingdom. The AGM in its meeting on 24 March 2020 approved forming the Shariah Supervisory Board and nomination of its members for three renewable years. The Shariah Supervisory Board members and the meetings during 2019 are as follows:

Shariah Supervisory Board attendance in 2020

Compliance and anti-money laundering

Compliance with regulatory and statutory requirements is an ongoing process. The Bank is conscious of its responsibilities in observing all regulatory provisions and best international practices in its functioning. The Bank has established an independent compliance function in keeping with Basel and CBB guidelines. The AML and Compliance function acts as a focal point for all regulatory compliance and for adapting other best practice compliance principles. The Bank continuously strives to improve the level of compliance in all its activities. The Bank’s adopted corporate philosophy is: ‘BBK shall continue its endeavour to enhance shareholders’ value, protect their interests, and defend their rights by practising pursuit of excellence in corporate life.’ Anti-money laundering measures form an important area of the compliance function, in addition to areas of corporate governance, disclosure standards, insiders’/key persons’ trading, conflict of interest, and adherence to best practices.

Starting 2014, BBK implemented an automated compliance system for the monitoring and management of regulatory requirements across the Bank.

This system facilitates the prompt reporting of any compliance concerns or non-compliance incidents as and when they arise, as well as monitoring the status of compliance with CBB Rulebook requirements as applicable to BBK.

The Bank has a documented anti-money laundering programme, including periodic awareness training for employees, record-keeping, and a designated Money Laundering Reporting Officer (MLRO). The AML policy and procedures are updated annually and were last approved by the Board of Directors in October 2020.

The Bank has deployed a risk-based automated transaction monitoring system in keeping with the anti-money laundering regulations of the CBB. The automated AML system of the Bank was upgraded in September 2018 and was rolled over to most of all the concerned divisions as part of system overall implementation across the Bank in order to further enhance the screening and monitoring of customers and their transactions.

The Bank’s anti-money laundering measures are regularly audited by the internal auditors, who report to the Audit and Compliance Committee of the Board. The Central Bank performs periodic inspections of the Bank’s compliance with anti-money laundering regulations; the last AML/CFT follow-up examination by the Central Bank was concluded in June 2020, and the most recent annual regulatory examination was conducted on March 2020 and final report is yet to be issued by the regulator. The annual inspection of the Central Bank covers all areas in the bank including Compliance and AML activities. Additionally, the Bank’s anti-money laundering measures are audited by independent external auditors every year. However, in light of the recent COVID-19 pandemic, the CBB has exempted licensees from the annual AML/CFT review conducted by the external auditor. The overseas branches in India and Kuwait and the subsidiary, CrediMax, have designated compliance and MLRO functions to ensure implementation of applicable regulatory requirements. The Bank is committed to combating money-laundering and, towards this end, implements all ‘Prevention of Money Laundering Regulations’ as stipulated in the Financial Crimes Module of the CBB Rulebook and other guidelines issued by the CBB. These regulations and guidelines are consistent with the revised FATF recommendations, ‘Customer Due Diligence for Banks’ paper of the Basel Committee, and best international practices.

Communication strategy

The Bank has an open policy on communication with its stakeholders, and has adopted a communication disclosure policy consistent with Basel II requirements. Shareholders are invited by the Chairman to attend the annual general meeting (AGM). The Chairman and other Directors attend the AGM and are available to answer any questions. The Bank is at all times mindful and conscious of its regulatory and statutory obligations regarding dissemination of information to its stakeholders.

The Bank provides information on all events that merit announcement, either on its website – www.bbkonline.com – or through other forms of publication. The Bank’s annual report and three years’ financial statements are also published on the website, as well as the Bank’s Corporate Governance Report, Corporate Governance Framework, Whistle-Blowing Policy, Board Charter, Code of Conduct, Key Persons’ Dealing Policy, and Terms of Reference of all Board Committees. Shareholders can complete an online form, which can be found on the website, to forward any queries they may have.

The Bank uses a bulletin board for communicating with its employees on general matters, and sharing information of common interest and concern.